Scanning the results of Healthcare Purchasing News’ 2018 Supply Chain Compensation Survey just might bring to mind the painful-for-many bracket-busting NCAA college basketball tournament three months ago.

Following a healthy jump in digits in last year’s report, this year’s cumulative overall average salary represented something of a hiccup — perhaps from celebrating too much.

The 2018 aggregate average salary for healthcare supply chain professionals slid 4 percent to $91,778 from last year’s figure, which had increased nearly 8 percent from 2016, according to survey results.

From a trending perspective, after steady increases during the five-year period between 2008 and 2013, salaries seemed to adjust downward a bit for the next two years before climbing again.

Still, this year’s overall result may be one of the lone blemishes against a backdrop of better news. In fact, while there may be statistical reasons for this year’s reported slippage those results may have little to do with employers disrespecting Supply Chain departments, going stingy or slashing labor budgets. This year’s survey attracted a larger pool of respondents, which may have led to a course correction with the data.

Despite the year-over-year dip, this year’s overall salary figure still clocks in at 48.3 percent higher than the $61,904 aggregate number reported a decade ago. For the record, in 10 years’ time, the aggregate average salary remains nearly $30,000 ahead of what happened during the economic fallout that sparked the “Great Recession.”

This should quell some calls for alarm, too: Of those respondents who reported a year-over-year salary increase, the average percentage increase was 3.4 percent, which is consistent with salary growth in recent years. And more than 88 percent of those respondents attributed their raise to job performance and not a promotion with a change of responsibilities or even just a change of responsibilities without a promotion in a “more work-less fulfilling” kind of way.

More than two-thirds of survey respondents (70.5 percent) reported a base salary increase for 2018, and another 26 percent stated their base salary remained the same, according to the survey. The aggregate average salary for those reporting a base salary increase was $98,491, which exceeds the overall aggregate average by more than $6,700, and represents a wider margin than the previous year’s result in this category.

Pulling back the curtain on the aggregate data element, however, lets a bit more sunshine into the equation.

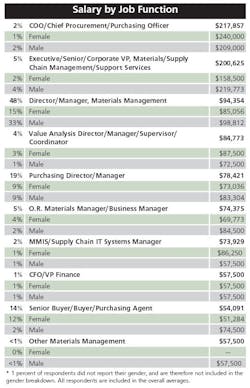

Of the seven job titles that HPN typically surveys for compensation data, six reported increases spanning 0.4 percent to nearly 25 percent. Respondents sporting the title of OR Materials Manager/Business Manager reported their average salary dropping more than 13 percent to $74,375 from the previous year’s results. One potential explanation may be that more respondents with that title participated this year, which may have impacted the data. Two respondent groups representing the largest reported increases, however, call that observation into question as more respondents participated this year within those title groups.

Respondents with the title of COO/Chief Purchasing/Supply Chain Officer saw their average salary soar nearly 25 percent to $217,857 for the year, according to the survey. Value Analysis Directors, Managers and Coordinators, meanwhile, came in second behind the top executive title, reporting more than 20 percent in growth to $84,773.

Still, among the four traditional titles within Supply Chain, two recorded average increases that outpaced the aggregate average. The remaining two treaded water.

Near the top of the pecking order the Executive, Senior, Corporate Vice Presidents of Materials or Supply Chain Management or Support Services reported an average salary of $200,625, a 7.1 percent gain from last year. In the storeroom aisles and trenches, on the other hand, the senior buyers, buyers and purchasing agents stated their average salary rose 5.3 percent to $54,091.

Purchasing Directors and Managers saw their average salaries bump up nearly 2 percent to $78,421.

The slimmest movement? Directors and Managers of Materials or Supply Chain Management eked out a 0.4 percent uptick to $94,354 on average. Note, however, that this title’s average outpaces the overall aggregate average by 2.8 percent, but remains below the average yearly raise, according to the survey.

As a customary cautionary caveat, HPN advises readers that survey data and trending perspectives hinges on the number and mix of respondents by job title, facility type and location, and gender. For example, more senior-level executives who lead centralized integrated delivery network (IDN) operations generally will elevate salary data, while more buyers at community hospitals may push the salary data lower.

Regional bracket busting

The larger respondent pool to this year’s survey upended a number of trends HPN has been recording and tracking over the years highlighting the areas where supply chain professionals might be likely to earn the most.

Based on these survey results over the years, HPN readers historically may be conditioned to expect that the coasts offer the best compensation gains.

Not this year.

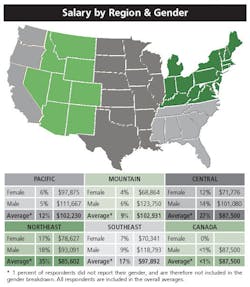

For 2018, aggregate average salaries for supply chain pros on the East Coast slid the most while those on the West Coast posted anemic growth at best. Further, the largest compensation growth year-over-year occurred between the coasts. Previously, the Pacific region ruled the compensation game for four consecutive years (and nine of the last 10), with the Northeast following as No. 2 for seven consecutive years. Survey results knocked both from their respective perches.

As part of its survey collection and analysis, HPN divides respondents into five geographic regions: Northeast, Southeast, Central, Mountain and Pacific.

Who vaulted to the top this year? Facilities in the Mountain region. The aggregate average salary for supply chain pros in the Mountain region jumped 6 percent to $102,931, which exceeds the cumulative aggregate average by more than $11,000, the survey showed.

The Mountain region nudged the Pacific region into the No. 2 spot for the first time in a decade by a mere $701, as supply chain pros on the West Coast reported an aggregate average salary of $102,230. This represented a meager 0.3 percent growth from last year’s results. The Mountain and Pacific regions were the only two regions to post six-figure salaries among the five regions.

The Southeast region returned to the third spot for the fourth time in five years. The aggregate average salary for supply chain pros in this region slipped 1 percent to $97,892, just shy of a $1,000 difference from 2017’s result.

The Central region bumped up to the fourth spot this year, courtesy of a 4.6 percent growth rate in compensation with the aggregate average salary reported at $87,500. Historically, the Central region has hovered among the lowest two or three regions for compensation gains.

Surprisingly, the Northeast region fell to the fifth and final spot, plunging to the lowest aggregate average salary of $85,602, which is almost $6,200 below the overall aggregate average. This represents a nearly 16 percent drop from last year’s results and a gap of nearly $16,000 year-over-year.

Gender gap squeezing

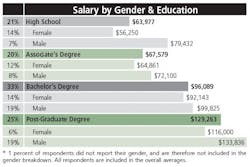

This year’s compensation survey highlighted a number of curious trends about the earnings between men and women. The larger number of survey respondents represented a narrower gap between the genders as nearly 53 percent were men and more than 46 percent were women, a transfer of about 1 percent — lower for men and higher for women.

Two years ago the aggregate average salary for men broke the $100,000 barrier for the first time, and while it remains above that threshold this year, it’s actually more than $8,200 closer than the result year before. That’s because the aggregate average salary for men among the five regions dropped 7.3 percent to $104,954 in 2018, down from $113,185 last year. The aggregate average salary for men this year is almost $13,200 higher than the overall aggregate average, a gap that’s $4,400 tighter than the one last year.

Women, on the other hand, reported their aggregate average salary jumped 4.4 percent to $77,465, a nearly $3,300 increase. Further, the gap between the average salaries of women and men narrowed to more than $27,000 in 2018 from roughly $39,000 the year prior, according to the survey, but that’s a small consolation in that the gap remains noticeably wide. The aggregate average salary for women this year is more than $14,300 lower than the overall aggregate average. The good news? The gap between the women’s average and the aggregate average is $7,000 tighter this year.

Among the regions, men in the Mountain region reported the highest average salary at $123,750, outpacing the Southeast at $118,793.

Men in the Pacific region earned the third-highest wages at $111,667, roughly $800 away from last year’s figure, followed by men in the Central region at $101,080, which is roughly $400 below last year’s figure. Men in the Northeast reported an average earning of $93,091, which represents its first dip below six figures in a while, and nearly $27,000 below last year’s figure, according to the survey.

The gap between the highest- and lowest-earning regions for men (Mountain vs. Northeast) expanded to nearly $30,700. In 2017, the gap between the highest- and lowest-earning regions for men (Southeast vs. Central) was nearly $21,000.

For the fourth consecutive year, women in the Pacific region earned the highest at $97,875. This represents a more than $9,800 increase from the previous year’s figure, which represented a nearly $8,200 drop from 2016. The average salary for women in the Pacific region surpassed the overall aggregate average for everyone by nearly $6,100.

The Pacific region remains the only region among women to outpace the overall number, according to the survey results. Women in Pacific region hospitals appear to be on pace to break the six-figure mark in 2019.

Women in the Northeast region came in second, reporting $78,627, more than $700 above last year’s total for that group, followed by women in the Central region at $71,776, more than $5,200 higher than last year.

Women in the Southeast region reported an average salary of $70,341, more than $1,000 below last year’s total, followed by women in the Mountain region at $68,864, more than $12,100 lower than the previous year’s total for women in that region.

The gap between the highest- and lowest-earning regions among women actually widened to more than $29,000, which is more than $7,500 higher than last year’s spread.

From a gender perspective, the regional salary gap between the largest and smallest ranges ballooned to its highest amount in several years — more than $41,000. That’s up from more than $28,200 last year, nearly $39,000 in 2016 and more than $25,000 in 2015, according to HPN historical survey data.

The Mountain region led the widest gender-based salary divide at nearly $55,000 (more than $4,000 higher than last year’s widest gap recorded in the Southeast region), followed by the Southeast at nearly $48,500, then the Central region at more than $29,300, the Northeast at nearly $14,500 and the Pacific at nearly $13,800. The cumulative spread among all five regions this year is more than $16,000 lower than the figure last year.

Demographic characteristics

One explanation for this year’s salary slip may be the titles for the vast majority of respondents. Nearly 74 percent of respondents (4 percent below last year’s figure) reported their department management position as Manager, Director, Vice President or higher for Supply Chain Management.

Nearly 48 percent claimed to be a Director or Manager of Materials/Supply Chain Management, another nearly 19 percent said they serve as Director or Manager of Purchasing, more than 5 percent Executive, Senior or Corporate Vice President and more than 2 percent COO or Chief Purchasing/Supply Chain Officer.

The remaining respondents were titled OR Materials or Business Manager, Value Analysis Director, Manager or Coordinator, MMIS/Supply Chain Informatics Manager and CFO/Vice President of Finance. In a break from prior surveys, HPN did not reach out to Administrators/CEOs or Contract/Service Line Administrators as part of the pool.

Unlike in previous years, however, survey respondents skewed more towards rural and suburban facilities than urban facilities, which also may have contributed to this year’s salary movement. This year more than 41 percent of survey respondents reported they worked in rural facilities with an aggregate average salary of $75,236 (compared to more than 37 percent last year at $80,378). More than 30 percent said they worked at suburban facilities for $102,527 (compared to more than 32 percent last year at $106,216), and nearly 29 percent said they worked at urban facilities for $104,290 (compared to more than 30 percent last year at $102,964).

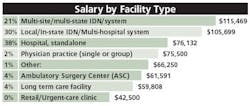

Nearly 60 percent of survey respondents said they work in standalone hospitals that were part of a group purchasing organization (GPO), higher than last year’s 52.2 percent. More than 29 percent were part of an integrated delivery network (IDN), lower than the 35.2 percent in 2017. Nearly 7 percent were part of an accountable care organization (ACO), down from 8.3 percent last year, and more than 4 percent were at a standalone hospital independent of a GPO, relatively consistent with 2017 data.

More than 77 percent of survey respondents said they work in non-profit facilities (aggregate average salary at $95,714, nearly $4,500 lower than last year), 17.5 percent in for-profit facilities (aggregate average salary at $76,991, more than $2,500 lower from 2017) and nearly 5 percent in government-owned facilities ($86,167, nearly $5,200 higher than last year). Respondent locations are relatively consistent with last year’s respondent pool.

Nearly 55 percent of survey respondents oversee supply chain management for a single hospital, according to the survey, while more than 16 percent said they manage supply chain operations for one or two additional hospitals, which is consistent with 2017’s respondent pool. More than 7 percent handle three or four additional hospitals. More than 5 percent of survey respondents said they oversee supply chain operations for five to six additional hospitals, 7.5 percent seven to 10 additional hospitals and more than 9 percent are responsible for serving more than 10 additional hospitals.

More than 85 percent of survey respondents handle supply chain operations for a variety of non-acute care facilities, including clinics, surgery centers and physician practices. In fact, nearly half (48.4 percent) provide service to more than six non-acute care facilities. More than 13 percent each handle one to two or three to four non-acute care facilities, and more than 10 percent fortify five to six of these facilities.

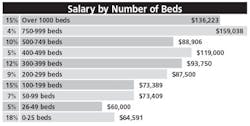

For the third consecutive year, survey respondents generally worked in larger facilities with the average size being 408.5 licensed beds with a 71.4 percent occupancy rate.

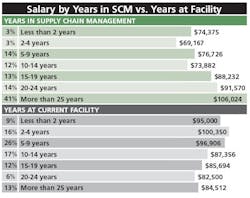

The average respondent to HPN’s 2018 salary survey is 53.4 years of age, has spent more than 20 years on average in supply chain management and nearly 12 years at his or her current facility. Their departments include 16.8 employees on average that service 2.7 hospitals other than their own and/or 8.5 non-acute care facilities, the survey showed. All of the results for these parameters remain fairly consistent with previous years on record.

About the Author

Rick Dana Barlow

Senior Editor

Rick Dana Barlow is Senior Editor for Healthcare Purchasing News, an Endeavor Business Media publication. He can be reached at [email protected].